The Rippling Price Strategy of AWS

Published:

AWS

- Product: Cloud Computing

- New or existing: Innovated an existing product

- Disruption: Replaced upfront capital and long-term hosting commitments with metered, on-demand pricing by giving developers access to storage and computing bandwidth on-demand via API which made computing more accessible to startups and small businesses.

- Target Market: Developers, small businesses, startups

- Competitive Landscape: AWS had the $$$ infrastructure under Amazon to scale quickly, gain economies of scale which reduced their cost and then AWS passed those savings to customers via lower prices building a strong moat that warded off competition for many years.

INTRODUCTION

Pricing strategy has the power not only to influence sales for a product but to reshape an industry and the entire economy. Pricing is the mechanism that determines who can afford to participate in an industry, how fast they can scale and what risks they inherently take. Amazon Web Services (AWS) illuminated this by replacing upfront capital and long-term hosting commitments with metered, on-demand pricing. Businesses traded fixed expenses like data centers and physical servers for variable ones by using Amazon’s infrastructure on-demand instead of acquiring their own.

The year 2000 commenced a decade when businesses sought to get on the web as the internet reshaped how people transact, communicate and exchange information. Amazon Prime (2005) gave subscribers access to free two-day shipping on hundreds of thousands of items and the iPhone (2007) dropped the internet into every hand. Facebook created new ways to network (2006) and Google created a platform for advertising (2000). The internet created needs where they didn’t exist and businesses were beginning to harness digitalization for product development, marketing and new channels created by online shopping.

Before 2006, businesses on the web had to procure computing infrastructure and equipment costing thousands of dollars. They needed to forecast the amount of storage capacity and compute power needed for the future to secure sufficient server equipment or risk being ill-prepared for surges and thus missing business opportunities. At the other extreme, overshooting compute needs led to computing infrastructure that sat idle. For firms in more seasonal industries like accounting, high intensity computing was integral but only needed for a few months every year, and for startups, budgets were tight and the future uncertain, so investments in servers and data centers carried a greater risk of capital gone to waste.

Then there was the issue of scaling. Scaling up to accommodate growth before cloud computing meant purchasing more servers, infrastructure, equipment and related services via painfully slow procurement processes. Amazon redefined the equation in 2006.

DISRUPTION

AWS released the S3 (Simple Storage service) in March 2006 and the EC2 (Elastic Compute Cloud) shortly thereafter. Developers could get rolling with a credit card and simply initiate a virtual server instance hosted with Amazon which was charged back based on CPU, storage and bandwidth usage. Rather than continuous term lengths, firms paid for their usage on-demand starting at a base rate of 10 cents (USD) per hour for server time and over a month of continuous use that added up to $72, which was comparable to traditional server providers at that time. It was even surmised (in an article on TechCrunch at the time) that these prices may not have been sufficiently low to compete with traditional server providers at the time as it remained to be seen whether the lure of the new model was not in its continuously available price but in the ease of launching and scaling it.

In their book Game Changer, Jean-Manuel Izaret and Arnab Sinha champion AWS strategy for its cost leadership approach likening it to that taken by low cost airlines like Ryanair and Southwest. These airlines reframed air travel as a commodity and took aim at consumers who were priced out by legacy carriers at the time.

Similarly, by changing to an on-demand model that can accommodate scaling but keeping the cost of long-term computing otherwise level, AWS may have been taking aim at new markets like smaller businesses with tighter budgets rather than seeking conversion from existing onces. Also by shifting from sales-led enterprise procurement to self-serve, product-led purchasing, AWS empowered developers to make

AWS GROWTH & RIPPLE EFFECTS

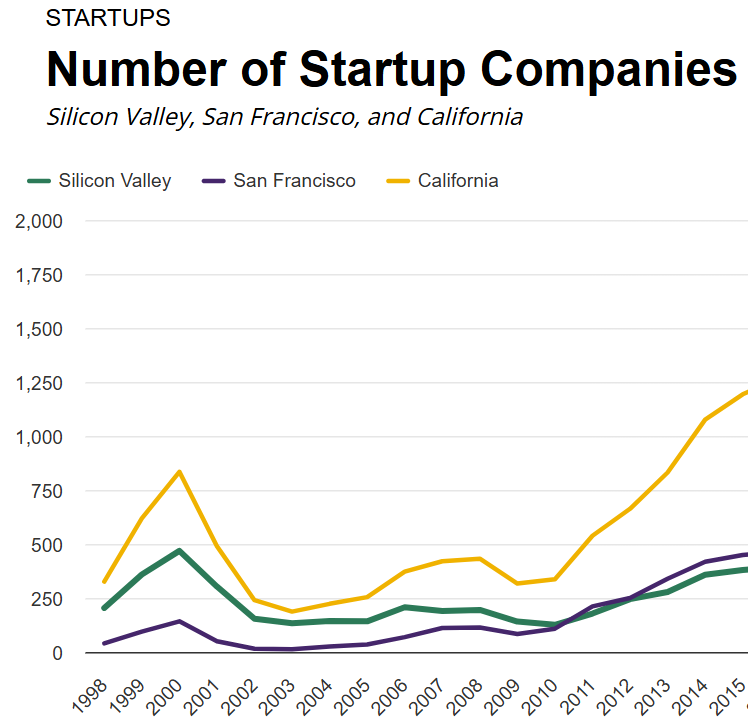

AWS immediately saw great success. By the end of launch day, over 12,000 developers had signed up for S3 and Amazon reported in their 2006 annual report that over 240,000 developers had worked with AWS by the end of the first year. Amazon’s success had ripple effects on other markets and industries. Startups could now get online with a credit card and pay a monthly bill for what they need instead of raising thousands to buy servers and access to data centers. Cloud computing became a key enabler of new business ventures as a Silicon Valley entrepreneur told Wired, “Infrastructure is the big guys’ most powerful asset. This levels the playing field.”. Had it not been for the financial crisis in 2007, we may have seen an immediate effect on startup growth but once he economy recovered, did see an acceleration (see below).

Chart from SiliconValleyIndicators.org

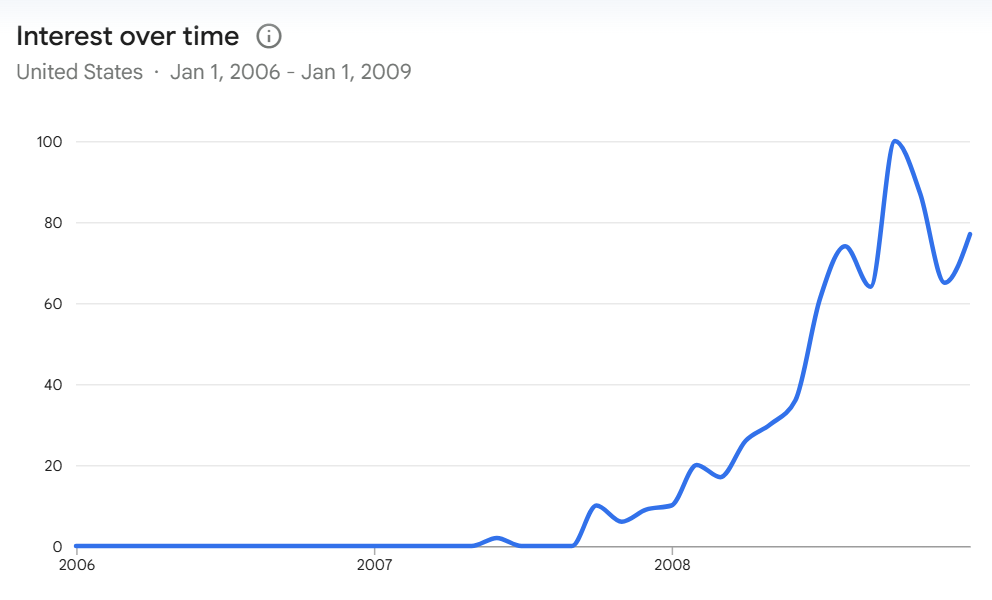

In addition, cloud computing was a little known term before rapidly grew in popularity by the end of 2007 (see Google trends chart below).

Jeff Barr wrote in his blog series,

COMPETITION

Amazon was navigating uncharted waters in entering the tech space as an e-commerce conglomerate.