How Share Everything Changed Everything

Published:

Key Takeaways

- Verizon's Share Everything plan changed the industry's pricing framework transforming how data was monetized

- Share Everything replaced device-by-device pricing with a single, shared data pool accessible by all devices on the same plan.

- Verizon gave consumers the ability to optimize data usage (and cost) across devices via data tiers.

- As more devices were added to plans, this raised the cost of switching thus reducing churn.

- Verizon timed switch with rollout of LTE aligning interests with customers encouraging adoption.

- New LTE technology brought faster data speeds and higher quality video which catalyzed data use which incentivized the purchasing higher data tiers generating more revenue for Verizon.

- This allowed Verizon to more effectively monetize the growing dependence on data.

Verizon Case Study

Between 2005 and 2015, communication technology underwent a seismic shift. Faster data transfer, the rise of smartphones catalyzed by the iPhone’s 2007 release, and the rollout of LTE technology reshaped how we connect. These innovations not only changed how people communicated but also transformed how carriers structured and monetized their services. This case study focuses on one pivotal case: Verizon’s shift in pricing models.

Old Model: Voice First

Verizon’s earlier pricing model monetized primarily through voice minutes and text messages, with only limited options for data. Families purchased a bucket of minutes shared across lines, but each smartphone required its own separate data package within the plan. Tablets faced an even clumsier setup—customers had to sign separate agreements with their own price tiers, making multi-device connectivity costly and inconvenient. The result was a fragmented structure that discouraged households from adding devices and left Verizon exposed as WiFi offered a far simpler alternative.

The 2012 Pivot: Introducing Share Everything

The Share Everything plan introduced by Verizon in 2012 changed all that by streamlining how we contract for cellular services. It replaced device-by-device pricing with a single, shared data pool - an overhaul that made multi-device connectivity far simpler. Verizon also moved beyond smartphones to allowing other internet-enabled devices like tablets and laptops to enroll in the same family plan as smartphone devices and also share in the data pool. By no longer requiring separate agreements for each device, the complexity of connecting new devices to the internet was greatly reduced.

Families that Telekom Together, Stick Together

“The greatest subscription retention product in history is The Family Plan,” - Brian Norgard, former Chief Product Officer at Tinder on X

The ease of connecting more devices induced customers to connect more smartphones, tablets and other devices. This led to an expansion in the number of devices per household under the Verizon umbrella and an increase in overall market share.

“With the shared pricing plan that we have, number one people are more enticed to add more devices. So if they have a Smartphone they’ll add a tablet, they’ll add a Dongle, they’ll add additional smart phones. Device attachment is increasing 4% quarter-over-quarter, year-over-year,” Verizon CFO Fran Shammo at Morgan Stanley Technology Media & Telecoms Conference

“Verizon is gaining market share in wireless. Unless one believes that industry growth rates accelerated — and we certainly don’t — Verizon’s gain is AT&T’s, Sprint’s, and T-Mobile’s loss,”

said by Sanford Bernstein analyst Craig Moffett in the NYPost,

More devices on a single family plan also raises the cost of switching providers. The more devices and individuals under a single plan, the more cumbersome it is to change. Tying multiple users into a shared plan creates a network of emotional, social and economic commitments. Family members will want to avoid inconveniencing other members or breaking shared routines. Primary subscribers feel responsible for the disruption that cancellation would cause their entire group. With more devices attached, the members of a plan become even more reliant. This gave Verizon more traction and price stickiness in the market for family plans. It is in this way group plans are structured so that margin is traded for massive reductions in churn.

Customer Adoption: What’s in it for me?

For consumers, the new pricing structure allowed them to optimize data use and generate a windfall in savings especially if they relied heavily on voice and text but used data sparingly.

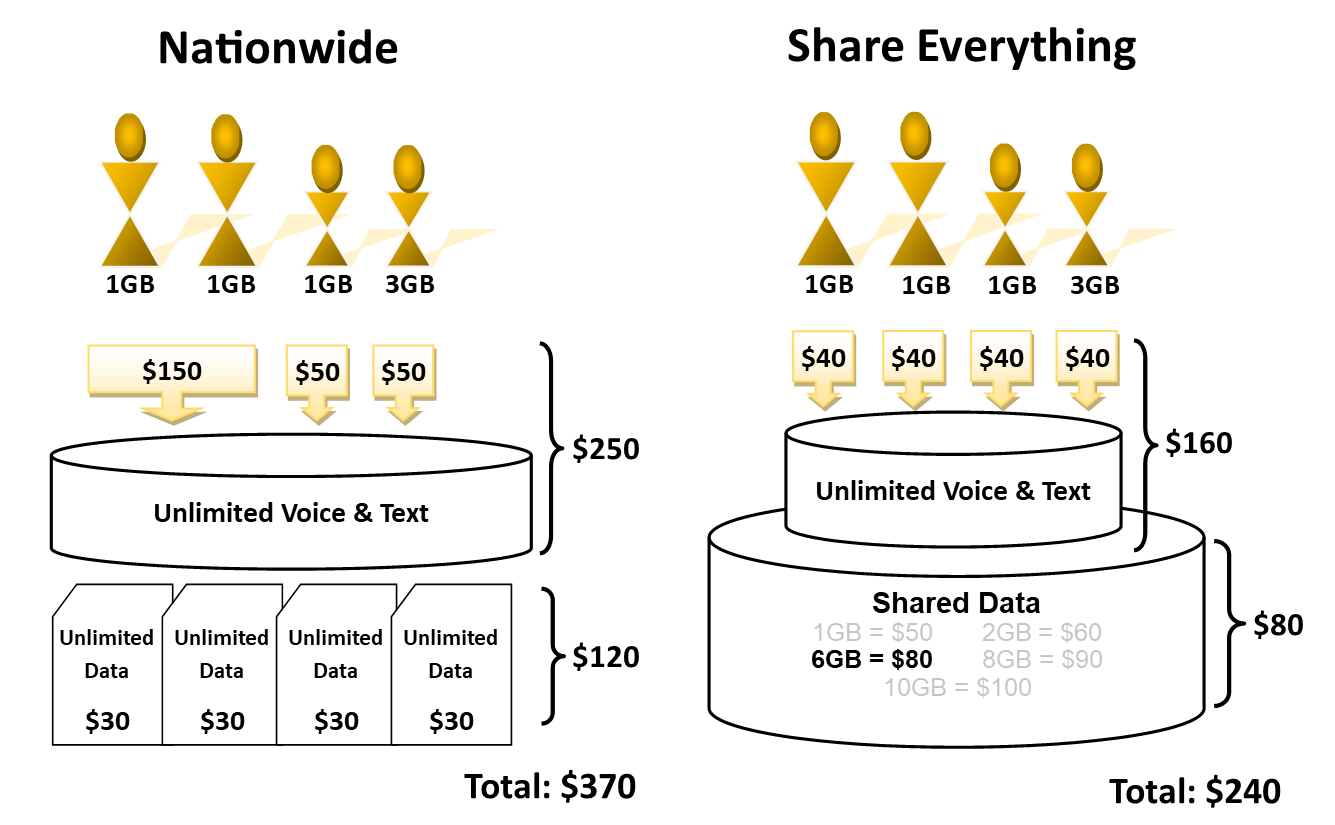

To illustrate, a Family Nationwide Unlimited Talk and Text Plan with four smartphones had a base price of \$250 (\$150 for 2 members plus \$50 for each additional). If three members of the family use only 1GB of data per month and another has more intensive usage of 3GB every month, then they would each have needed to add on an unlimited data package for \$30 arriving at a data cost of \$120 and a total plan cost of $370 under Nationwide. See the left side of chart 1 below.

For a family that only requires 6GB of data, Share Everything changes that equation by allowing the family to scale back their data allotment to exactly the amount they need (6GB) in this case. Under Share Everything, each smartphone device pays an enrollment fee of $40 for unlimited voice and text for a base cost under the family plan of \$160 for all four devices, and instead of purchasing a data package for each device, 6GB of data is purchased for the entire plan for \$80 dollars and is shared by all four devices. This amounts to a total plan cost of \$240, \$130 less than under Nationwide, a substantial savings for consumers. See right side of chart 1 below.

Chart 1: Nationwide vs Share Everything Price Structure: for a Family of Four with mixed data usage.

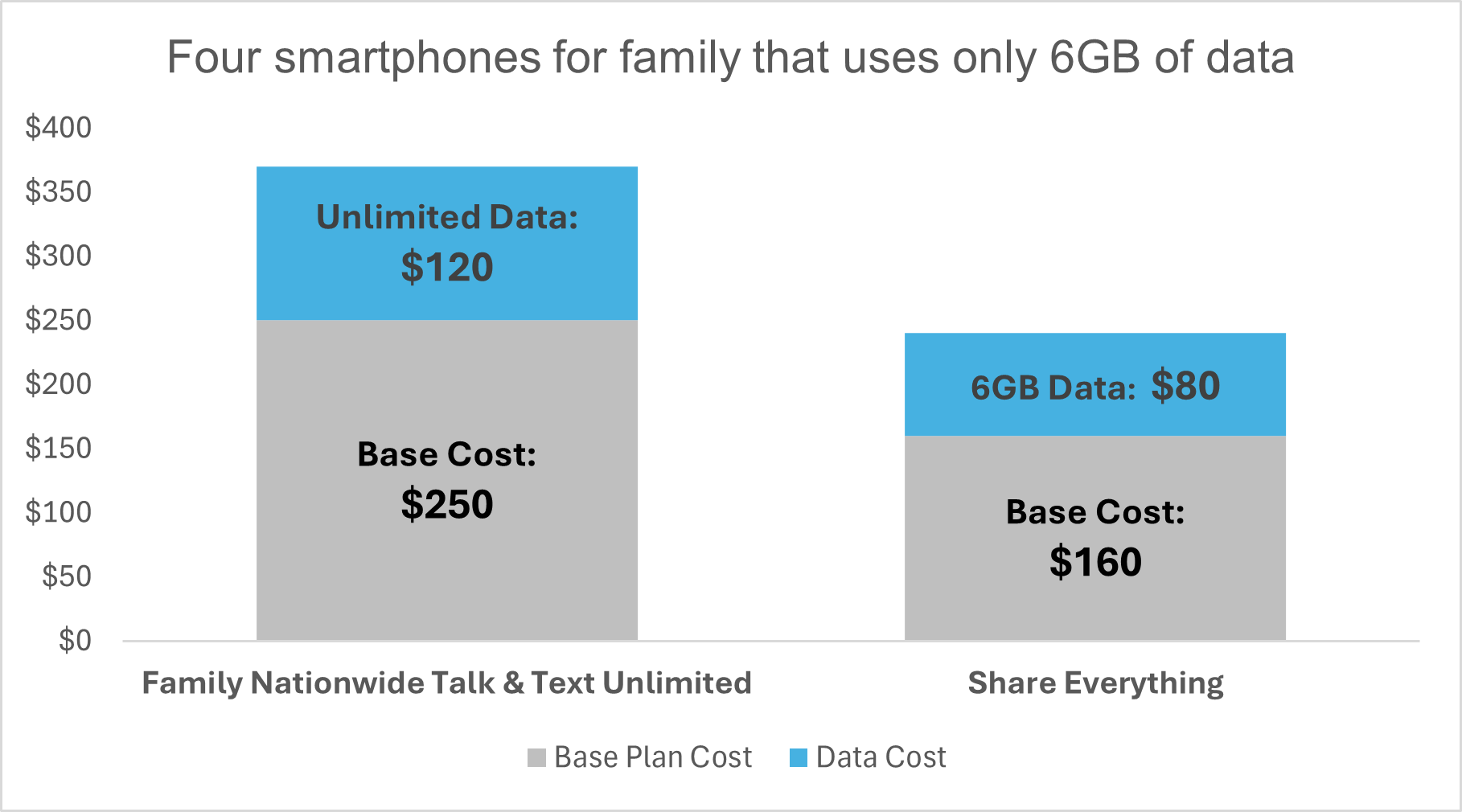

Differentiating price on the amount of data and giving consumers the ability to pool data allows a family of four that uses 6GB of data in total and previously spent \$120 (\$30 per smartphone) on data with Nationwide to spend only \$80 on a data pool shared by all four devices under Share Everything.

Chart 2: Bar chart illustrates cost savings breakdown across voice, text and data as shares of plan cost for a family of four that uses only 6GB of data.

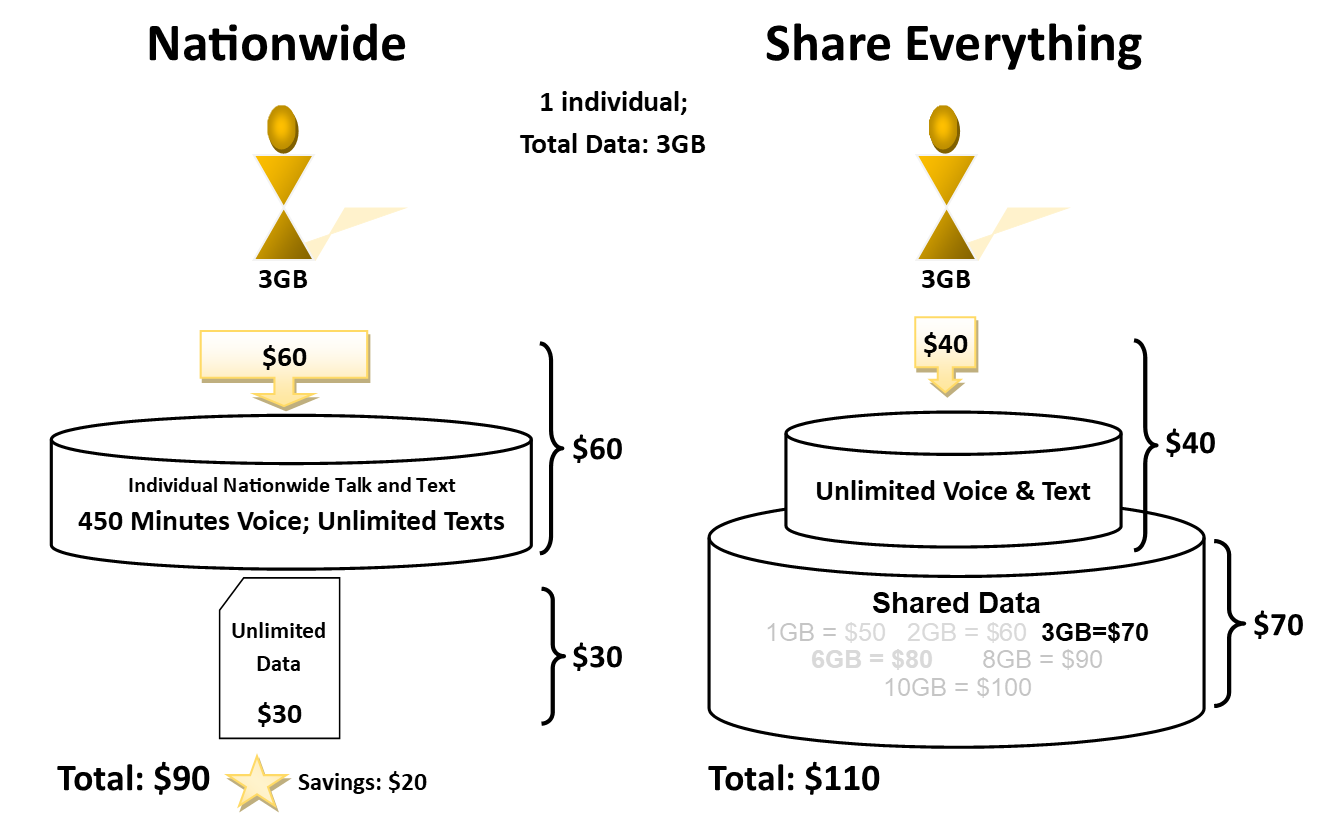

Not everyone benefited from the new price structure. An individual that used a lot of data but relied much less on voice and text, could have ended up paying more on a Share Everything than staying grandfathered on a Nationwide Family Plan with an unlimited data package.

An individual using 3GB of monthly data on an Individual Nationwide Talk and Text paid \$60 for 450 voice minutes and unlimited domestic texting and \$30 for unlimited data thus totaling \$90. This produces a \$20 savings with Nationwide over the \$40 device fee + \$70 3GB of data, a total of \$110. See diagram below.

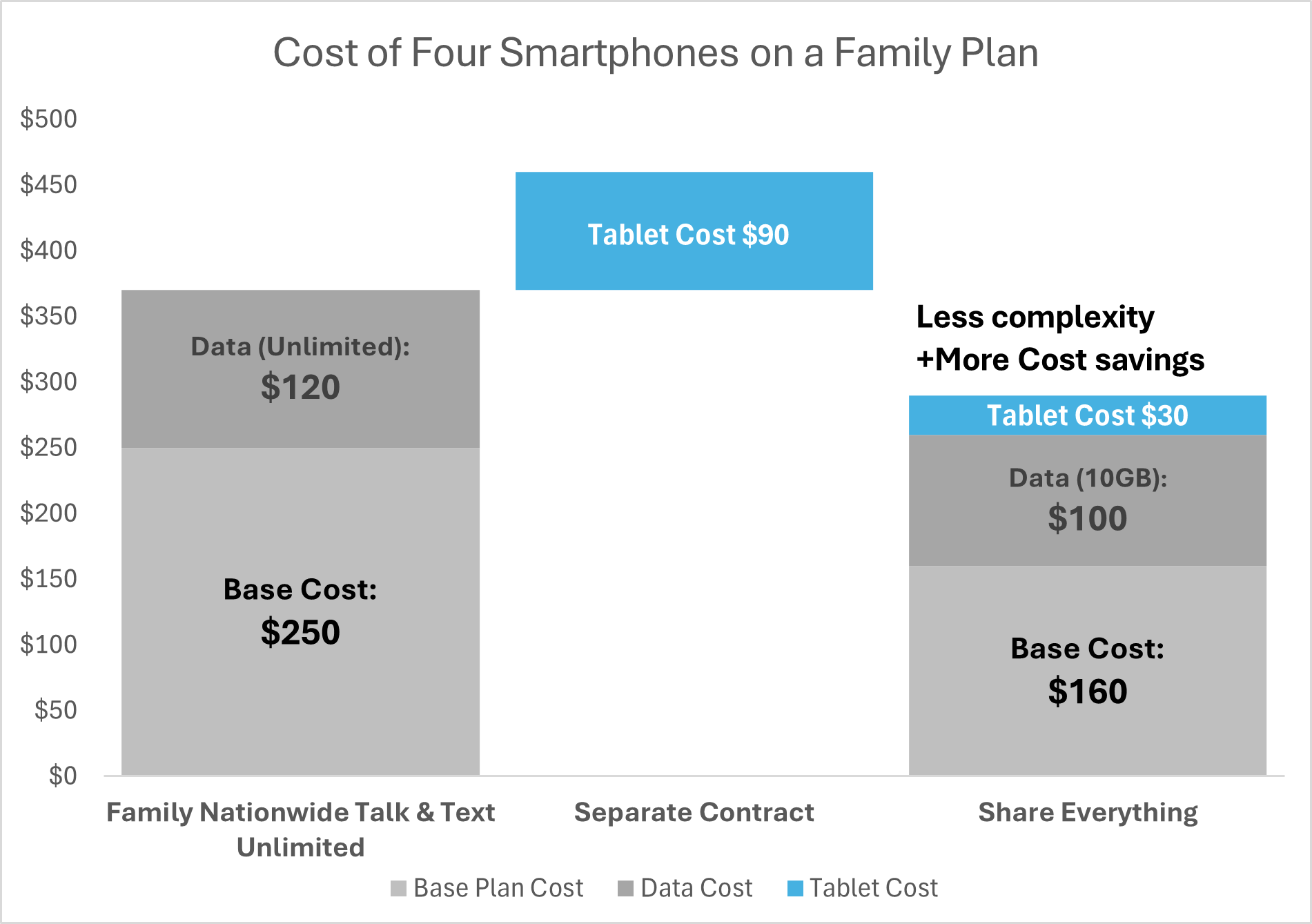

This chart demonstrates how Share Everything transformed device connectivity overall

Turning LTE into a a Pricing Catalyst

For cellular service providers, Verizon paved a new path to monetizing users’ growing reliance on data as web-based communication became the norm. It’s earlier pricing model had fallen out of alignment by leaning heavily on voice and text, even as consumer behavior shifted decisively toward data-heavy applications like video streaming, messaging and social networking applications.

Verizon timed the launch of its Share Everything plan with the industry’s transition from 3G to 4G LTE. This was no coincidence: LTE was not just faster, it was transformative. Offering speeds up to ten times higher than 3G and significantly lower latency, LTE made real-time applications–video calls, online gaming, and app-driven services–practical at scale. It also expanded network capacity, allowing more devices to connect simultaneously without congestion.

By linking a major technological upgrade with a new pricing structure, Verizon reframed data as the centerpiece of its value proposition. The LTE rollout created both the technical foundation and the consumer demand to justify shared data plans, positioning Verizon to capture revenue growth from rising data consumption and paving the way for future categories like cellularly enabled household devices in the early Internet of Things.

For telecoms, the shift to 4G LTE, a tiered price structure for data and making that shareable across multiple devices effectively turned data into a revenue driver. Faster data transmission and quality video provided by 4G and the ease of adding devices to surf from on facilitated a feedback loop of increasingly higher data utilization. This was well articulated by Fran Shammo, Verizon Communications Inc., EVP & CFO at the Morgan Stanley TMT conferences in 2013:

"...what's also driving this growth is the fact that you have 3G customers migrating to 4G and what we see is that the minute that they migrate over their video consumption goes way up and they're more than doubling, if not doubling, their usage on the 4G network versus the 3G network,”

“...it's really the consumption of the data and the LTE network really allows video to perform very nicely. And what we're seeing is that consumption is driving usage up so people are buying up in the tier. So, really, it's base consumption and device attachment that's really generating the growth,”.

and in November 2013 shareholder statements:

And if you think about the generations to come, video is going to become much more efficient to put through that network. So the initial LTE network is extremely efficient compared to 3G, but then when you get to 4G advance and then 5G ultimately the compression technology, the speed technology, video is going to be more consumption into the future. ”

and Shammo’s remarks demonstrating the progress made to that effect:

So we see that if you look at it we have about a third of our customers on shared, we have a third of our customers on LTE. And if you think about a third of that customer on LTE is consuming 64% of the data traffic in Verizon, you can imagine what that is in New York because that 64% is across the entire US,"

Another incentive to join Share Everything was subsidized phone upgrades which stopped being available under the older plans. To stay on grandfathered plans that offered unlimited data, those customers now had to pay the full cost for new replacement phones.

Share Everything turned out to be a great success transforming not only Verizon but for the entire telecom industry as AT&T soon followed with a similar structure.

Many Verizon customers held onto their Nationwide unlimited data deals with white knuckles. Here is an entire Reddit thread dedicated to collectively strategizing how to stay on them.

Resources

- Images generated using MS Publisher, MS Excel & ChatGPT 5.

- Article: How Family and Group Plans Improve SaaS Retention and Reduce Churn