Ticketmaster Debacle

Published:

Ticketmaster made headlines over the past two weeks for mishandling ticket sales for an upcoming Taylor Swift tour but with all the griping, it was easy to lose sight of the main issues causing it. Each person I asked offered a different hypothesis of the issue tossing around phrases like monopoly and high prices.

Tickets went on sale on November 15th, and people all over the U.S. queued up to purchase but it turned out that demand was higher than Ticketmaster’s systems could handle. As fans signed on and called in to wait on virtual queues behind thousands, the systems became overwhelmed. After waiting for hours, many people were confronted with error messages and subsequently kicked out of the system.

Joining the vocal backlash of disappointed fans, Taylor Swift made the following statement on November 18th, “I’m not going to make excuses for anyone because we asked them, multiple times, if they could handle this kind of demand and we were assured they could.”

Why would a firm not take measures to mitigate the risk of system failure for one of the highest grossing artists of the age?

Because Market Power Kills Innovation!

In competitive markets, firms seek innovation and efficiency as needed to stay on par with other firms in their market competing for business. With less competition, there is less pressure to innovate. Therefore, market power could allow companies the slack to spend less on innovation and efficiency. Why should they fear losing the business of angry fans and stakeholders if there aren’t other players in the market?

What is Ticketmaster’s share of the primary ticketing market believed to actually be?

In a 2010 report, the DOJ estimated that Ticketmaster held at least 80 percent of market share in 2008 (Competitive Impact Statement, United States of America v. Ticketmaster Entertainment, Inc., No. 1:10-cv-00139 (D.D.C. Jan. 25, 2010)).

Is 80% market share enough to constitute a monopoly?

It is not always clear but on their website, the FTC states that when making conclusions about a firm’s conduct, they look at whether the firm has significant and durable market power to raise price or exclude competitors but if the estimate of market share is less than 50 percent of the sales of a particular product or service within a geographic area, then the firm is usually deemed not to have monopoly power.

Market power is not inherently bad though and often arises naturally.

A monopoly is not a concern when achieved through superior service and innovative products. It becomes a problem when that dominance is achieved through predatory means, or when unfair advantage grants the firm the ability to penalize consumers with unethically high prices or exclusionary practices that elbow out other firms from the market.

Part of Ticketmaster’s market power can be attributed to how the primary ticketing business is structured. In the ticketing business, high startup costs create barriers to entry for potential competitors. Having venues typically sign long-term, exclusive contracts could also discourage new entrants into primary ticketing in a seemingly saturated market.

What is bad is when a monopoly gives a firm unfair advantage over not only consumers but also other businesses

Market power can give a firm sway over negotiations with key stakeholders.

In 2010, the US Justice Department (DOJ) approved a merger between Ticketmaster and Live Nation giving birth to the colossal Live Nation Entertainment. Live Nation Entertainment now owns the largest primary ticket seller and the largest promoter. A promoter contracts directly with the band or artist and is responsible for securing venues, advertising, transportation and other touring needs.

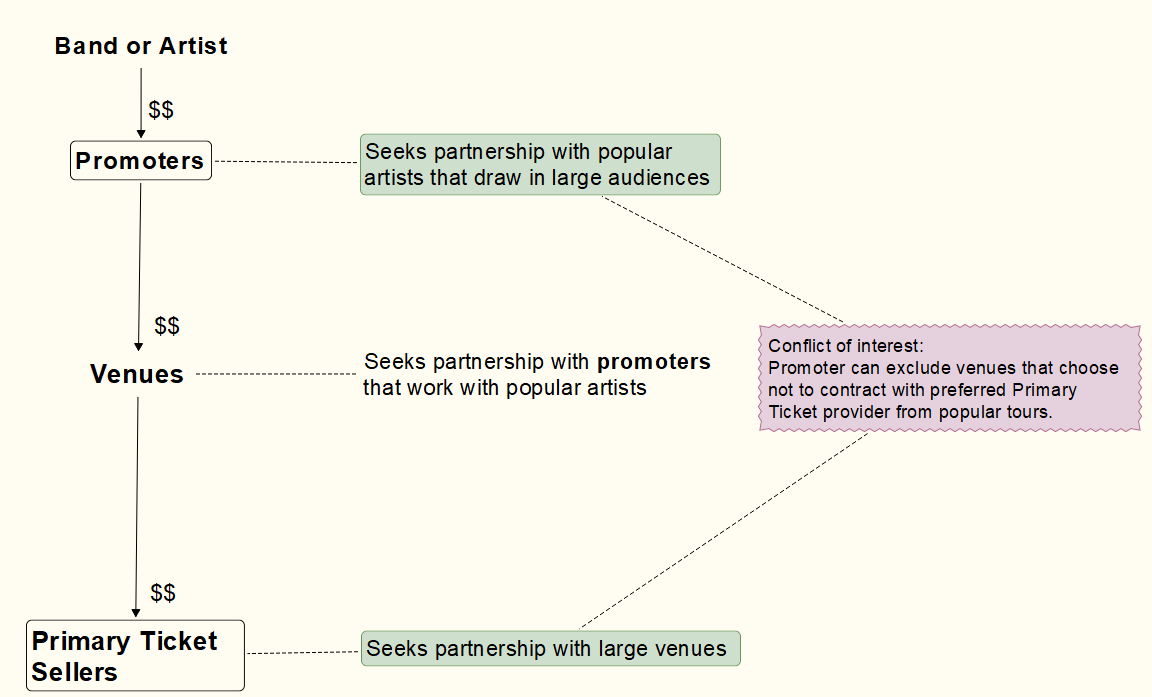

Primary ticket sellers like Ticketmaster contract with venues and venues contracting with promoters benefit from access to tours with artists who have large audiences. A promoter and primary ticket sales partnership could create incentives to coerce venues into exclusive, long-term partnerships with the primary ticket seller in order to secure access to the promoter’s set of tours. In this situation, the promoter could employ exclusionary tactics that harm venues which choose not to partner with the primary ticket seller.

Below is a chart illustrating how the three key players in the primary ticketing game interact:

The Bottom Line

What does this have to do with Taylor Swift?

The main problems for Swifties are (1) Ticketmaster pre-sale fiasco and (2) high ticket prices.

Market power may have led Ticketmaster to underinvest in site stability resulting in lackluster service. Had it faced credible competition it may not have taken the consumer experience for granted.

High ticket prices can arise naturally via market forces of supply and demand. The high markup on ticket prices seen in the secondary market, even suggest that the face value initially set for the primary market is lower than that actual market clearing price. However, another way for ticket sellers to extract revenue is through add-on fees like drip pricing mechanisms whereby add-on costs are revealed in the finalization stages of a transaction when consumers are least likely to make comparisons and weigh their decision.

Note: These views are my own and do not reflect those of my employer or any other organization of which I am a member.